So you are, or are not an Angel. But as commenters pointed out from that post there are several ways to invest, and we don?t want to scare off potential investors.?I got some flack for being a bit too negative, and sure, perhaps I was a bit harsh. Everyone starting a business is looking for money at some stage, and anyone wanting to get involved and help with funding is welcome.

As the number of investors, founders and investments grows in New Zealand, we can start to lift our understanding of what great looks like. We should expect and demand certain behaviours from both founders and investors, and we should expect us all to get better over time.

We get better, as an industry, by doing more. It takes all types of models to?figure?out the better approaches, and there is no one true way.

Investors that invest and founders that start and grow companies are all learning. They are learning through their mistakes and their successes, and they are learning by investing or starting up multiple companies. Some of the success stories, and Xero is a classic example, rely on years of founder and investor experience before the company is even formed. Others come out of the blue, but the founders and investors come back for more (Hyperfactory, 42 Below). It?s all welcome, and we are progressively gaining building momentum.

What founders want.

Founders are looking for investors with the right balance of speed, expertise and funds. As an investor you need at least one of these attributes, and great investors have all three.

What investors want

Investors are looking for great returns on their investment and an easy time with it. They often also want to help. They need to be confident on the potential of the business, the quality of the team and the price of the investment. Founders who are realistic in their assessment of the business potential and valuation will encourage investors to come on board more quickly. As one investor I know says, founders should ?value the cash?.

Being fast

Investors and founders want to make decisions quickly yet with confidence, which means founders need to be able to provide the right level of information, and investors require the right level of professional and legal negotiation, due diligence and contracting. There?s a common language involved, and as everyone gets more experience it becomes easier to make deals happen.

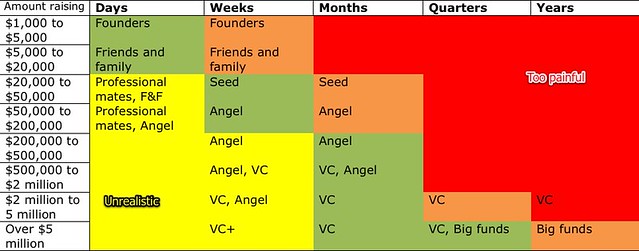

The ?right? level of preparation and rigour for investors and founders depends on the size of the investment, which also dictates the expected speed. The handy table below, and yours may vary, shows what I believe are the sweet spots for investment sizes and the expected time to complete a deal.

The green boxes are the target times for each investment bucket. Investing at these speeds is a healthy rate which allows founders to maintain momentum while investors can perform an appropriate amount of investigation, negotiation, due diligence and contracting. The orange section is worryingly slow, yellow unrealistic for most and the red section is far too painful for the founder, who should reassess the potential of the business and look elsewhere for funds.

The amount and time period dictates the amount of work done by each party to raise the money. Just how much work and what should be done, I intend to discuss, by investment size, in a series of forthcoming posts.

Saying no fast.

Speed of decision making and execution is an imperative for founders, as the fund raising process takes an?extraordinary?amount of time and effort away from the core business. While it might seem right as an investor to keep asking for more information, often the kindest thing to do when uncertain is to say no very quickly. Most investors will have defined investment criteria, which they and founders use as an initial filter. They are good tools to help to say no.

While the process will vary depending on deal size, there are always things each party can do to make things faster, or slower. From a founder perspective it?s smart to talk to previous people who have succesfully or unsuccessfully dealt with the investor. From an investor?s perspective it?s smart to make rapid decisions based on defined criteria, and to have simple processes. This might mean investing less than you really want to, or using tranches to ensure the company meets certain targets along the way. Other times it is going to mean cutting a few corners and taking a punt on the team ? and that?s what a lot of this is about at the earlier stages.

Overall if you have lots of money to offer then you can afford to take your time and ponder the investment. If you are are throwing around only a few thousand each time then you?ll be expected to move very quickly. There is more?uncertainty, but less to lose and higher potential percentage returns.

Expertise

Investors with industry expertise should be able to assess your product and strategy more quickly than their peers, for a given investment size. They might get it wrong (founders will see this as them saying ?no?), but they should offer good advice along the way. They are preferred partners and and other investors involved will look to them for their lead.

Investors with less expertise are actually ok, provided they are bringing something to the table, which is usually huge amounts of funds or credibility. We should not expect those funds to appear quickly, and should realise that a significant amount of industry education may be required.

End note

For the record ? I don?t regard myself as an angel as I?m not a HNW individual. The money I invest is generally all of the free cash I have earned from consulting, and has ranged from a few hundred dollars (with sweat) to a few hundred thousand per investment. I?ve averaged about 3 investments or companies a year for the last 3 years, and prefer to hold the investments, hopefully forever.

I tend to understand companies and industries very quickly and can make rapid decisions, but I don?t have the necessary ?war chest.

I?m also ?improving? on my ability to judge teams, as I tend to think everyone is awesome. That?s largely true as over the years I?ve learned that almost everyone is somehow held back from realising their true potential, and I?ve seen that start-ups have a way of bringing out the best in people.

Source: http://lancewiggs.com/2011/12/22/investing-with-appropriate-speed/

how to make it in america how to make it in america schweddy balls schweddy balls hedy lamarr bill conlin clippers

কোন মন্তব্য নেই:

একটি মন্তব্য পোস্ট করুন